Blockchain Bridges & how do they work?

-

by ZKE Research

by ZKE Research

Blockchain bridges are technical solutions for transferring data back and forth between two blockchains.

Blockchains aren’t designed to be interoperable. They exist as isolated domains with unique operating logic, prioritising security and decentralisation. But there is a growing demand for users to move their information and assets between blockchains. Blockchain bridges, also known as cross-chain bridges, solve this problem.

You can understand the role of blockchain bridges by imagining two planets that want to exchange goods. They have entirely different languages and ways of conducting trade but don’t trust each other.

They need a neutral system for accurately verifying transactions that can make sense to each planet separately, without relying on trust and which neither side can manipulate—an interplanetary information bridge.

Why do we need crypto bridges?

A blockchain is a database maintained across a distributed network of global independent computers with no one in charge. They provide revolutionary new ways to manage any type of data without formal hierarchies, from digital payments to tokens or the latest state of a shared agreement.

Though complicated, the core feature of blockchains is verifying the data they hold without trust. Each computer (known as a Node) runs a piece of software that describes how each point of the network can agree on the true state of the data stored in the chain without any central coordination.

That agreement is known as a Consensus Mechanism. The Nodes are continually verifying new blocks of data based on that mechanism. That could be recent Bitcoin transactions or updated Ethereum account balances.

As the crypto ecosystem has grown, users want to transfer their assets across different blockchains (such as from Bitcoin to Ethereum) in a trustless way. Given consensus works internally to each blockchain, how do you verify a cross-chain transaction?

This problem is described as the Interoperability Trilemma as verifying transactions between separate blockchains needs to reconcile three distinct requirements:

- Trustlessness: having equivalent security to the underlying chains

- Extensibility: able to be supported on any domain.

- Generalisability: capable of handling arbitrary cross-domain data

How blockchain bridges work

The solutions to the Interoperability Trilemma and verifying the flow of data between separate blockchains fall under two main categories:

- Centralised/Trusted Bridges

- Decentralised/Trustless Bridges

Centralised Bridges

Centralised bridges provide a solution to interoperability by compromising on the trustless component of the trilemma through External Verification; aka off-chain.

Off-chain verification can be through a single traditional centralised entity such as Bitgo acting as a custodian to bridge Ethereum and Bitcoin. It can also be through systems that aspire to decentralisation, but that nonetheless ultimately fail the trustless requirement, such as ChainBridge and its system of off-chain relays.

Decentralised Bridges

Decentralised bridges provide solutions to blockchain interoperability that are trustless but struggle to apply to any domain or any type of asset. There are two different approaches to decentralised bridges.

Locally Verified

The locally verified blockchain bridge solution assumes that each party to a cross-chain exchange assumes responsibility for verifying their counterparty. This type of bridge is trustless and can work across any domain, but is specific to exchanging a specific asset, so again trips up on the trilemma.

Natively Verified

Native verification of cross-chain transactions requires each blockchain to create custom validators – known as relay clients – working within the other chain’s consensus mechanism. This approach satisfies the trustless element and can handle any data but cannot be generally applied; it requires a custom solution for each cross-chain bridge.

Ethereum Blockchain Bridges

Ethereum is the dominant blockchain for supporting decentralised applications, particularly in the sector known as DEFI – decentralised finance. DEFI includes a whole range of financial services for crypto users, such as lending/borrowing and swapping. Given the problem of blockchain interoperability a significant proportion of the value within the crypto system is locked out of Ethereum-based DEFI applications.

For that reason Ethereum bridges are crucial to growing DEFI, and naturally, one of the first to emerge was with Bitcoin through what is known as wrapped Bitcoin.

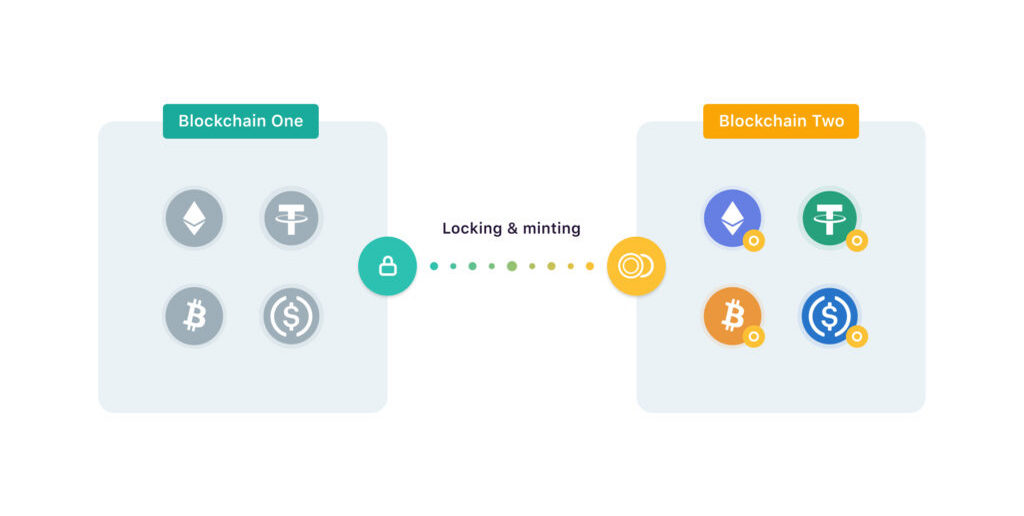

One of the most popular Ethereum-Bitcoin bridges is Bitgo, which uses the centralised bridge approach. It acts as a single trusted Custodian bridging Bitcoin and Ethereum through a lock-mint/burn-release approach.

- You send your BTC to Bitgo

- BitGo locks up your BTC & mints a ‘wrapped version’ of Bitcoin called wBTC

- You receive wBTC in an Ethereum supported wallet

- To redeem your BTC send the wBTC back to Bitgo

- Bitgo burns the wBTC & unlocks the original amount of BTC

- You pay a fee to both wrap & unwrap

wBTC complies with the ERC-20 token standard used by Ethereum, so it can be used across its ecosystem.

- See our separate article on wrapped tokens

At the time of writing, there is almost 270,000 wBTC in circulation, mainly used in DEFI applications.

What are the best blockchain bridges?

As challengers to Bitcoin and Ethereum have emerged so have solutions to bridge between the growing number of layer 1 chains.

Solana

Solana has huge appeal as a layer one chain given the significant throughput it can achieve, with 50,000 transactions per second, compared to Ethereum with just 30. As Solana and its ecosystem have developed the need for bridges quickly emerged.

Wormhole is one of the most Solana bridges providing a cross-chain link to Ethereum. It uses the lock-and-mint approach, described above, listening out for transactions from each side of the bridge, locking up funds and minting an equivalent amount on the other side as wrapped version.

The other natural off-chain destination for Solana assets is Bitcoin and similar PoW chains. REN VM Bridge again uses the lock-and-mint approach to bridge BTC, BCH, ZEC and DOGE.

Avalanche

Avalanche is considered one of the genuine challengers to Ethereum, as similar to Solana, it offers improved throughput. You can bridge any ERC20 token to Avalanche and back using the Avalanche Bridge.

Polkadot

Polkadot provide an interesting dimension to the interoperability debate, positioning itself as the blockchain of blockchains, or layer 0. This solves the cross-chain problem because it creates a broader environment with which compatible blockchains can exist, built using the single Polkadot framework.

Unless, or until, all blockchains are built on Polkadot, the cross-chain issue will still persist, so there are bridging solutions for Polkadot:

- Interlay – Bridging Polkadot and Bitcoin using PolkaBTC

- Snowfork – A general purpose bridge between Polkadot and Ethereum for ERC20 assets and Smart Contracts

- Darwinia – Using a light client approach for native verification on Ethereum and a number of other popular chains.

Terra

Terra is a blockchain protocol supporting decentralised Stablecoins pegged to fiat currencies. It has seen significant increase in use given very generous returns from applications like Anchor with a 20% APY.

Naturally Ethereum users want to get in on that action so the Terra Bridge is very popular, enabling holders of wrapped versions of Terra assets like Luna, to swap for native versions. Terra Bridge also supports assets from Binance Smart Chain and Cosmos.

Chain Agnostic

ChainBridge provides a chain agnostic approach to bridging, but can only do so by using an off-chain approach requiring trust. Events on a source chain are routed to the destination chain through trusted (off-chain) relayers who, between them, verify the data:

- Listener: extract events & construct a message

- Router: passes the message on

- Writer: interpret & and submit messages to the destination chain

Though ChainBridge aspires to a more decentralised model, it suffers the same problem as Bitgo and custodial bridges – they are counter to the decentralised principles of blockchains.

A centralised service verifying data is a single point of failure because it can censor a transaction or simply abuse the trust that you have to place in them.

Are blockchain bridges safe?

The downside of trustless blockchain bridges is that the increased complexity increases the attack vectors, as illustrated by two massive hacks in early 2022.

In February the Wormhole Bridge hack saw 120,000 Wrapped Ether (wETH) tokens, valued at $326million, stolen from the Solana side of a bridge to Ethereum.

The Wormhole incident was quickly eclipsed by the attack on the Ronin Bridge resulting in the loss of an estimated $625million of tokens at the end of March.

In both cases one side of the bridge was exposed through a technical vulnerability. This doesn’t just lead to the loss of assets held by the exposed end of the bridge but has significant knock-on effects.

When funds are bridged blockchain A holds the original funds and mints a synthetic version that is sent to blockchain B. If the funds held by blockchain A are then stolen, all blockchain B holds is a worthless IOU because there is no longer anything backing it. As those IOUs end up in liquidity pools elsewhere the effects ripple through the wider crypto ecosystem.

Advantages of blockchain bridges

Transaction Fee & Price Efficiency

Without bridges each blockchain has a monopoly on what users of their supported assets can do. As more bridges connect to each of the layer 1 blockchains and their layer 2 applications, that monopoly is broken and users have more choice in how they transact.

Users can search for lower fees and better liquidity increasing the overall efficiency of the crypto ecosystem.

Encouraging diversity

Blockchain bridges encourage users to venture outside the domain of the particular assets they hold. So someone holding only ERC20 tokens can still experiment with dApps on Solana or Polkadot, using a bridge, which creates a greater diversity of experience.

Moving crypto forward

The siloed nature of blockchains contributes to tribalism within the crypto ecosystem and is an impediment to its overall growth. Cross-chain bridges support a progressive case for a multi-chain crypto universe which may help wider crypto adoption.

Disadvantages of blockchain bridges

Central points of failure

As one of the most popular solutions to bridging blockchains is to require some level of trust this naturally brings the disadvantages of a single central point of control.

This could either be in the form of censorship of access or transaction, bad faith on the part of the central point of control (rug pull) or the vulnerability to external attack.

Increasing Complexity

In order to mitigate the difficulties presented by the Interoperability Trilemma bridging solutions are incorporating increasing levels of complexity. This can discourage crypto adoption as the user experience is too painful, as well as increase vectors resulting in the incidents like the Wormhole and Ronin hacks.

More Fees

Blockchain bridges are a service, and so have to charge fees to cover development costs and reward users who might be providing liquidity. Having to pay fees every time you make a cross-chain transaction may discourage adoption from a mainstream audience less concerned about principles like decentralisation and more focused on tangible cost and benefits.

There is no utopian solution to the problem of blockchain interoperability. Blockchain bridges will evolve and improve, and users migrate to the most convenient and cost-effective ways to leverage the full value of their crypto assets without being restricted to a single blockchain domain.

Blockchain bridges are technical solutions for transfer…