What is cryptocurrency?

-

by ZKE Research

by ZKE Research

What is Cryptocurrency?

- A simple definition of crypto & what you can do with it

- How crypto can have value & the concept of sound money

- The evolution of money & the gold standard

- A simple explanation of how Bitcoin works

Cryptocurrency is a new kind of internet money. You can use it to buy things online, and you can send it instantly to other users anywhere in the world, at very low cost, needing nothing more than a smartphone and an internet connection.

Cryptocurrency can be cheaper and more convenient than many existing services like Paypal or Transferwise, if – for example – you regularly send money overseas. Several million people are actively using it today for that purpose.

Worthwhile as that is, it isn’t what’s drawing people’s attention

As well as functioning as a new type of internet money, cryptocurrency is also a very popular form of investment, with eye-popping long-term appreciation.

€60,000,000What €1 invested in 2009 in Bitcoin is worth in 2021

Newcomers to cryptocurrency find this aspect very confusing. How can this new internet money, which can’t even be touched, be so valuable?

How does cryptocurrency have value?

To answer that question we need to take a short trip back in time and trace the evolution of money.

By understanding why we started using money we can strip it back to its fundamental characteristics and discover a concept called sound money.

The characteristics of sound money give us a template against which to measure the money we use right now, and the improvements cryptocurrency promises to deliver.

Into The Time Tunnel

Archaeologists have found evidence of collectible items going back 75,000 years, such as beads and pierced animal teeth. Their choice wasn’t random; they were durable, not particularly abundant and clearly had special value (often used as jewellery) and we know they took a lot of effort to make at a time when life was short and energy at a premium.

These collectibles were passed on as a family heirloom or as part of important ceremonies as their durability and scarcity enabled them to act as a store of value and a precursor to money.

When our ancestors stopped being nomadic, and developed specialist skills, they were able to exchange their surpluses. On a small scale, a village for example, they could keep a mental note of who owed what – a credit or trust based system – and what a fair exchange rate was – how much wheat in exchange for a cow.

This credit system became less useful as the number of items being exchanged increased, and the two sides of the exchanging weren’t local, so credit on trust wasn’t practical; the solution was to find something suitable as a universal medium of exchange for goods and services; early collectibles were natural candidates and thus became the first money.

Early versions of money included coconuts, cattle, rice or salt (the Latin salarium being the root of the word salary), but it took Aristotle in 350 BC to articulate what makes something more suitable and useful, as money. His ideas still apply today forming the concept of sound money.

The characteristics of sound money

A key property of gold is that it is almost impossible to destroy (durable) but can be melted down into smaller units (divisible), which are relatively easy to transport (portable) and when divided, each unit has identical properties (fungible).

It is also very recognisable, which isn’t surprising as it has intrinsic value due to its colour and shine.

Gold cannot be manufactured, you can only get more of it by digging it out of the ground, but because of the difficulties in mining it, the stock of gold tends to change at a very predictable rate – this gives it the important property of scarcity.

So sound money, effective as a medium of exchange or store of value, has these properties:

- Durable

- Divisibile

- Fungibile

- Portabile

- Recognisable

- Scarce

This gives us a good yardstick to measure sound money candidates against, and should help address the question of whether cryptocurrency, as a potential new form of money, has value.

What is important about sound money is that it has a natural evolution. All civilisations independently employed forms of money – varying depending on geography and culture – and all of them, over time, voluntarily gravitated to better (sounder) mediums of exchange or stores of value.

Gold remained the dominant form of money up until the Italian Renaissance (from around 1420) when the one weakness in gold – the difficulty of transporting large amounts – was addressed with the introduction of Paper Notes, redeemable at a bank for the gold it represented.

The Gold Standard

This was the beginning of what we call the “gold standard” – paper money, backed by gold. This continued until 1971, when US President Richard Nixon changed the rules, allowing governments to create money without any mechanism for converting it into an equivalent amount of gold.

Of course we now know that this breaks one of our golden rules of sound money – scarcity. The new system instead requires us to simply trust our governments to decide how much money should be created and for what purpose. This is known as Fiat Money, which literally means – this is money because the government says its money.

In retrospect we should have known that the combination of trust, government and money would end badly.

$27 trillion

The US National debt is currently over $27 trillion and rising.

The reason scarcity matters is that creating more money (known as increasing the money supply) makes the money you might have saved worth less; this is called inflation. In countries that totally lose control of their money you get hyperinflation, when your money is worth nothing.

As the saying goes, trust comes in on a snail and rides off on a horse, so how do you get back to sound money and regain people’s trust?

How cryptocurrency can return us to sound money

To get back to sound money we could return to the gold standard, but heavy metals aren’t exactly ideal for a digital world; the answer comes from cryptocurrency.

Cryptocurrency is specifically designed to include all the characteristics we’ve discovered about sound money; be convenient for the digital age but with no one point of failure.

Instead of a central authority, cryptocurrency monetary systems instead rely entirely on maths – more specifically, on a branch of maths called cryptography.

This is where the “crypto” part of the name comes from, and what makes the idea of cryptocurrency so revolutionary. The first and most important cryptocurrency is Bitcoin.

Bitcoin – Ultimate Sound Money

Before we jump down the Bitcoin rabbit hole, let’s make a distinction: Bitcoin (with capital B) refers to its money system – whereas bitcoin (lowercase b) refers to its units – the money itself.

Bitcoin was the first cryptocurrency to find a successful solution that ticks all the boxes of sound money with none of the risks of a single controlling authority.

Let’s explore how it achieves those two things.

Achieving Trust

By far the most revolutionary aspect of Bitcoin is that it requires exactly zero trust in a central authority – which as we’ve learned, has led to ludicrous national debts driven up by catastrophic financial crises (2008), and the impact of the Covid Pandemic (2020).

Bitcoin solves the trust issue by taking control of the monetary system out of one pair of hands – the central authorities’ – and into many hands of a wide network of dispersed users, none of whom have ultimate control. This is what the term decentralised means.

Of course Bitcoin did have a creator, (we’ll learn more about them in the next lesson) but the greatest gift they gave was to remain anonymous and relinquish any control, understanding that Bitcoin could only succeed as trusted sound money, controlled by the many, not the few.

All these users locally run some software that maintains the Bitcoin network, creating an ongoing consensus of every user’s balance of bitcoin. All Bitcoin transactions are final and can’t be arbitrarily reversed unless all users agree, so as the network grows, it becomes more secure.

These users (also known as Nodes) are incentivised to support the network and maintain its accuracy.

The use of cryptography secures transactions against fraud and theft, while allowing anyone to mathematically verify the correctness of all transactions in the system.

You can’t bribe maths. No matter how much you try to sweet-talk, massage, or threaten an equation, you won’t change its result. So in retrospect, it really shouldn’t be so surprising that maths – combined with computing – was the answer to the problem of trust in the money system.

Bitcoin’s design makes it impossible to freeze, seize, spend someone else’s coins, or to spend the same bitcoin twice. If you try to double-spend your coins, only one of the transactions will go through – any others will fail;

So when you want to send 0.5 bitcoin to your friend, you can use a smartphone app, a bit like your personal banking, and the network is incentivised to agree that your balance has 0.5 deducted and your friend, 0.5 bitcoin added.

Unlike national currencies, Bitcoin is a global money system, recognising no borders. It can be exchanged nearly instantly, at any time. There are no “Bitcoin banking hours” and no KYC.

But what about the principles of sound money, I hear you ask? Well Bitcoin has those covered too

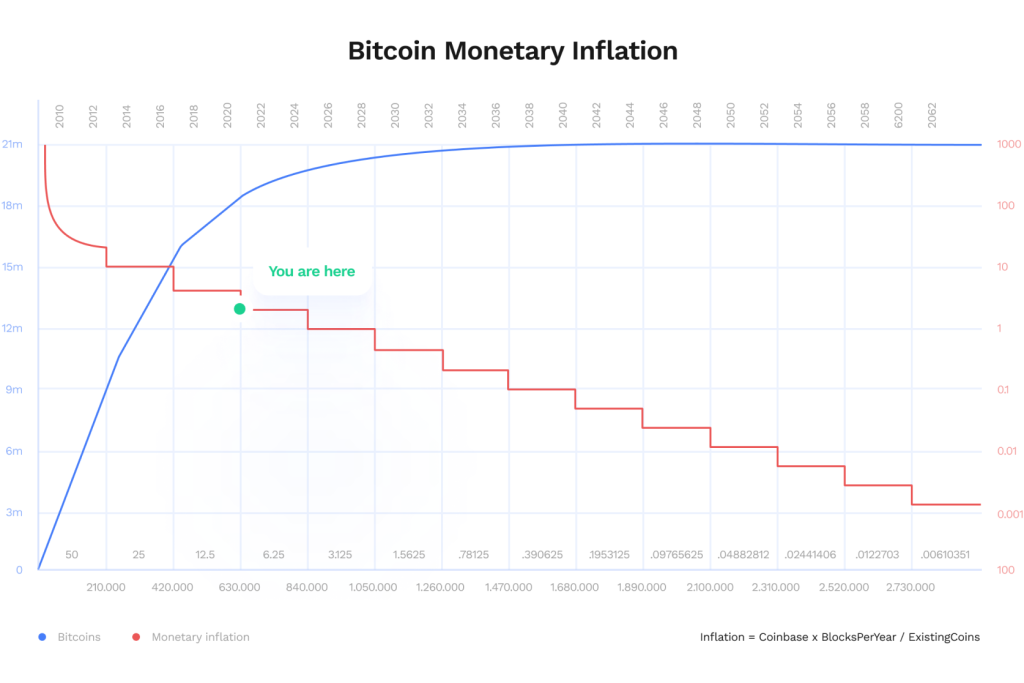

- Scarce – There will only ever be 21 million bitcoin in circulation, and new ones are mined (the process by which new coins are created) at a predictable pace. This means that there won’t ever be a sudden tsunami of new bitcoin flooding the market generating inflation

- Durable – With so many users maintaining the network it would take an unimaginable catastrophe to knock them all out at once.

- Portable – It is just data after all so you can use your phone, a USB device, or even just a QR code on a piece of paper.

- Divisible – Bitcoin has its own special denomination to eight decimal places. Tick.

- Fungible – The beauty of a decentralised system is that no one can make special exemptions*; every Bitcoin is created equal.

The difference with centralised crypto

In the modern crypto landscape, Bitcoin is merely one of several thousand types of cryptocurrency and digital assets. A key difference in the newer forms of digital assets birthed in the years following Bitcoin’s emergence is that many of them bear very few similarities to Bitcoin in terms of its decentralised nature.

Unlike Bitcoin, which requires zero trust in a central authority, many cryptocurrencies, tokens, or digital assets actually do rely in varying degrees on central authorities, either to run its operation, or to affect its market value. There are several signs of such cryptocurrencies:

- They have a company that issue the cryptocurrency, unlike Bitcoin new coins are supplied through a distributed and decentralised network that anyone can take part in.

- The network is maintained and secured by a few entities, not at all like Bitcoin which is a public network that anyone can participate in to help secure it.

- Their developers tend to also be large-scale stakeholders, owning vast amounts of the crypto. These developers also decide what to do with the network, and decide its development journey. Bitcoin’s governance is decentralised and requires time-consuming consensus processes to agree and implement a new development upgrade.

- Their operations are not transparent and it is very difficult for the public to see precisely what’s going on in terms of supply and operations.

Finance is a confidence game. Everyone from investors to entrepreneurs have to believe that the system works, that players are held to the same standard, and that a buyer of last resort will appear in a moment of crisis.

Anthony Pompliano, 10 November 2022

The rapid downfall of the second-largest crypto exchange in the world, FTX, in late 2022, provides further evidence that centralised crypto is not sustainable because trust in them is only as good as the confidence that the markets have in them.

Bitcoin continues to prove its worth in times of crisis, an actually decentralised digital currency used by millions of people, with the strongest computing network backing it. Whereas with most centralised crypto, at risk of owners and developers fleeing responsibility and covering up misdemeanours, Bitcoin provides confidence and security to create this unique form of trust.

Two for one – Internet money & investment

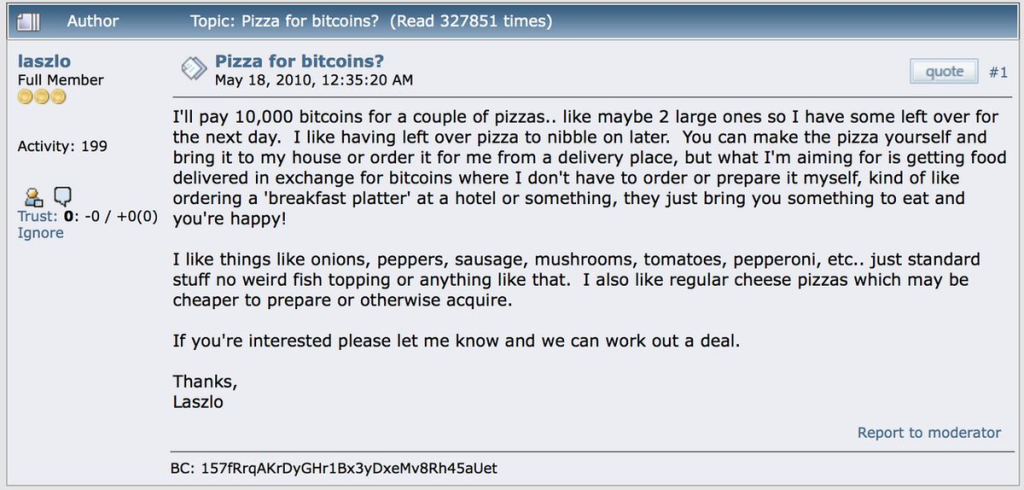

When the Bitcoin system launched, its currency, bitcoin, was pretty much worthless. It wasn’t until 2010, when someone paid 10,000 BTC for a couple of pizzas, that bitcoin began to give signs that it could be used as money.

$600,000,000

Equivalent cost today for the two Papa John’s pizza Laszlo Hanyecz bought on May 22nd, 2010, for 10,000 BTC, the first commercial bitcoin transaction. Celebrated each year as Bitcoin Pizza Day.

As of April 2021, that would amount to US$ 600,000,000 – easily the most expensive dinner in History. Clearly belief in the Bitcoin system has grown dramatically as people go on the journey you are now taking, learning about sound money.

But is anyone using it as money? Yes, there are over 1 million active Bitcoin addresses (users) particularly those suffering from the hyperinflation mentioned earlier, which constantly reduces the purchasing power of their existing money and those looking for a strong store of value.

Hopefully you’ve now understood in basic terms what cryptocurrency is, and how it tries to achieve the function of sound money. As the first cryptocurrency, Bitcoin’s design has opened up a new phase in our journey to find the best sound money, and this is just the start.

You’ll discover in later lessons how Bitcoin is evolving and as more people understand it, new improvements and refinements are made.

The final frontier for bitcoin is volatility. Even though its price and popularity are increasing, it is still susceptible to big swings in value because in truth Bitcoin is still in its infancy, so congratulations, you are early to the party.

But as more and more people own (and use) it, there’s every reason to believe that cryptocurrency will become more stable over time, and prove to be the ultimate form of sound money.

What is Cryptocurrency? Cryptocurrency is a new kind of…